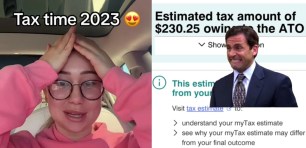

TikTok users are going viral while sharing tax return shocks. Here’s why

Australian taxpayers are using TikTok to share their surprise and disappointment at their 2022-2023 income tax returns, highlighting some of the significant tax changes that came into effect last financial year.

ATO warns copying and pasting work-related tax deduction claims could land Aussie taxpayers in hot water

ATO Assistant Commissioner Tim Loh said this week there are some key changes to look out for this tax time when claiming deductions.

Tick tock: SMEs have until June 30 to claim up to $20,000 in tech tax bonuses

The Technology Investment Boost promises 20% ‘bonus’ tax breaks to small businesses investing up $100,000 in new tech, equating to a maximum deduction of $20,000.

Piece of cake: ATO reminds taxpayers to lodge returns only after being ‘tax ready’

Taxpayers are being reminded by the Australian Taxation Office (ATO) not to rush lodging their annual income tax return from July 1.

EOFY checklist for SMEs: The overlooked tax deductions you need to know

This easy checklist for business leaders has you covered, from commonly overlooked deductions to simple tips and more.

From GST and PAYG to family trusts: Former ATO expert lists common small business tax mistakes

Tax time is often the most stressful time of the year for small businesses, but a former Australian Taxation Office official has listed four tips to help entrepreneurs avoid the tax office's ire in 2023.

Small business deductions worth $1.55 billion appear in the 2023 tax return but are yet to pass into law

Australian lawmakers only have a handful of days to enact $1.55 billion in 'bonus' tax deductions before the new financial year begins, leading the tax office to provide new guidance to small businesses banking on those kickbacks for their 2022-2023 tax return.

ATO reveals tax-time hitlist, cracking down on dodgy WFH claims and capital gains errors

The Australian Taxation Office (ATO) has revealed its priority hit-list for the end of financial year period, reminding workers and businesses to stay on top of their work-related expenses and potential capital gains requirements.