Source: SmartCompany

Thousands of words have been written since the Workplace Gender Equality Agency (WGEA) released the pay gap data for Australian employers with more than 100 employees for the first time last week. I’ve personally seen everything from incredibly positive stories (eg how Culture Amp produced the lowest pay gap in the tech sector), negative backlash (eg CEOs of poor-performing companies making excuses for their bad results) to distracting redirections (eg whether a 0% pay gap is even realistic because “biology”).

Amongst all of the commentary, there is a big grey elephant in the room that no one is talking about — and that’s what I will call the gender equity gap.

Pay gaps go further than salary

The median gender pay gap for Australian tech firms shows a huge range in gender pay gaps exhibited by Australian tech companies (from CultureAmp at 5.2% through to Rokt at 34.9%) when we look at the base salary (orange numbers).

When we look at “total pay” (the blue numbers, which include salary plus superannuation, overtime, bonuses and other payments) that gap becomes even greater. This is embarrassingly noticeable for companies like Rokt, Employment Hero and WiseTech which show an increase in the gender pay gap once “total pay” is considered of 17.5, 14.2 and 4 percentage points respectively. Most companies show some increase, as does the industry and national figures.

What about the gender equity gap?

Digging into the fine print these blue numbers include “share allocations”. Given that bonuses are relatively uncommon in tech companies (outside of sales teams), we can probably assume that share allocation is the largest contributor to the difference between the blue and orange numbers. Note: it is unclear whether “share allocations” include grants under employee share option plans (as these are technically options, not shares) – my assumption would be that options are not included in WGEA reporting, meaning that the gap between men and women would be even greater once options were factored in.

Kim Hansen, co-founder at Cake Equity, tells me that most employee share option offers in startups are given on a percentage of salary. Naturally that follows that if male employees take home a greater share of the salary, then they will also take home a greater share of equity options on offer.

It’s bad enough that the gender pay gap typically becomes greater when shares are added to the equation. But what happens to that gap if the company is wildly successful, and the value of the shares increases?

Let’s work through an example.

The pay gap for the “professional, technical, and scientific industry” is 24.8%.

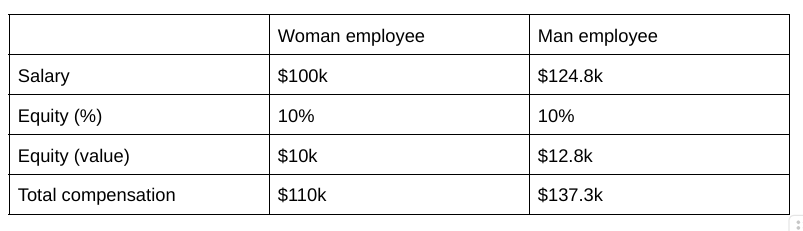

If we take a baseline salary of $100k for a woman employee, using this industry-level gap we should assume a corresponding baseline of 124.8k for a man. If we assume 10% of salary is given in an employee share scheme, the overall compensation looks like this:

Source: Supplied.

That’s the starting value based on the share price at the time those shares are allocated. What might this be worth by the time the employees are able to sell these shares? That depends, of course, on the future share price, which is unknowable. However, in this hypothesis we’re talking about a company that becomes wildly successful — so let’s assume those shares increase in value 100-fold.

That means that by the time our two employees are able to sell their shares, the woman employee takes home a tidy $1 million from her share sale, while our man takes home $1.248 million. So what started out as a $27.3k compensation gap turns into a $272k gap in total value once those shares are realised (that’s $248k plus the original 24.8k difference in salary).

Pretty bad, huh? It gets worse.

As companies have become better informed about gender pay gaps, they are getting better at correcting for their natural biases as well as well-documented social factors including that men are more likely to try to negotiate their salary, and are more likely to be successful when they do ask for more money.

Faced with the choice of either disappointing (or perhaps losing) their hot male recruit versus meeting their salary demands (at the expense of their gender pay gap), I’ve seen many founders and HR leaders find a middle ground by instead offering the male employee an increase in share allocation. Everyone feels good: the employee gets a better deal, the company keeps its pay levelling intact, and the pay gap looks minimal.

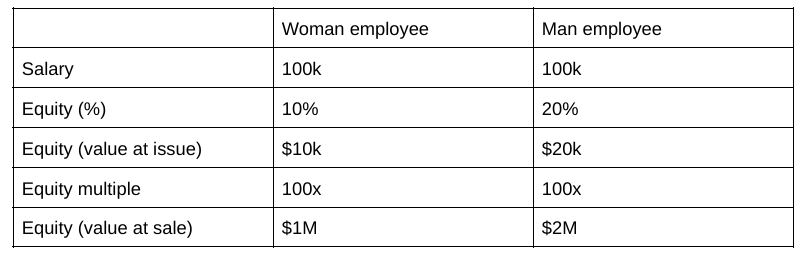

Let’s look at the impact of this using a similar example, where our man and woman employees both accept a salary of $100k but negotiate different share allocations.

Source: Supplied.

So that bump in equity negotiated by our male employee is worth an extra million dollars by the time the value of the shares is realised.

Employee equity can be life-changing. But mostly for men

When we zoom out to the industry level the impact of this problem at scale becomes a terrifying flywheel that entrenches gender inequality in the tech ecosystem. Let me explain.

- The cycle begins when male founders take home the majority of VC capital (82% of capital flowed to all-male founding teams in 2023 according to the State of Australian Startup Funding Report by Cut Through Venture).

- Flush with cash, male founders recruit their founding teams, which often include people in their existing network, and typically skew strongly towards male employees (see the gender imbalance in the Kiki founding team, of five men and one woman, for a recent example).

- The early hires take “a bigger piece of the pie” ie a greater share allocation compared to later hires (see commentary in Cake Equity’s State of Aussie Startup Employee Equity Report)

- Women operators joining later in the startup’s journey receive lower share allocations, which in turn are further impacted by the gender pay gap.

- The company is wildly successful — hooray!

- Early employees join in a secondary share sale (like the $1.5 billion secondary sale that Canva is planning for later in the year) and cash in their shares for money.

Following this thread further, we can expect to see more male operators cashing in big time in secondary share sales, and for the extent to which male operators cash in to be greater (on average) than the windfall received by female operators.

That means fewer female operators receive a life-changing amount of money for their contribution to their company’s success.

And fewer female operators with the discretionary funds to become angel investors (only 18% of active angel investors in 2023 were women according to the State of Australian Startup Funding Report).

Lower diversity in angel investors leads to lower diversity in angel investments.

And so, the cycle continues.

Sounds bad. What should we do?

For starters, company leaders must take steps to address their gender pay gap, and in doing so they must also consider their gender equity gap.

HR leaders should report to their boards on the overall split in the employee share allocations by gender at the company-wide level, as well as within teams and across functions.

Rather than tying share allocation to a percent of salary (and therefore delivering a gender equity gap alongside a gender pay gap), leaders can consider introducing standardised levels within their employee share scheme. When I was the CEO of a previous business, we had three different levels within our employee share scheme: one for executives, one for senior leaders, and one for everyone else. That meant that a junior engineer got the same number of shares as a member of the contact centre, removing the equity gap that emerges when the work of male-dominated functions like tech is valued more highly than female-dominated functions like customer service.

Above all else, track your data, discuss your data, share your data with your team — be open about the problems in your organisation and work together with your team to take action.

Gender equity within companies is everyone’s business, but action and accountability start at the top.

Kirstin Hunter is the Managing Director (NSW) at Techstars.

Handpicked for you

“Breaking Female Founders”: FOI reveals more “appalling” BFF grant issues

COMMENTS

SmartCompany is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while it is being reviewed, but we’re working as fast as we can to keep the conversation rolling.

The SmartCompany comment section is members-only content. Please subscribe to leave a comment.

The SmartCompany comment section is members-only content. Please login to leave a comment.