Melbourne, Victoria. Source: Adobe/Sean Heatley.

Victoria’s startup scene has broken the $100 billion valuation barrier, but more work must be done to ensure early-stage startups have access to the capital they need, according to a new report from LaunchVic and analytics firm Dealroom.

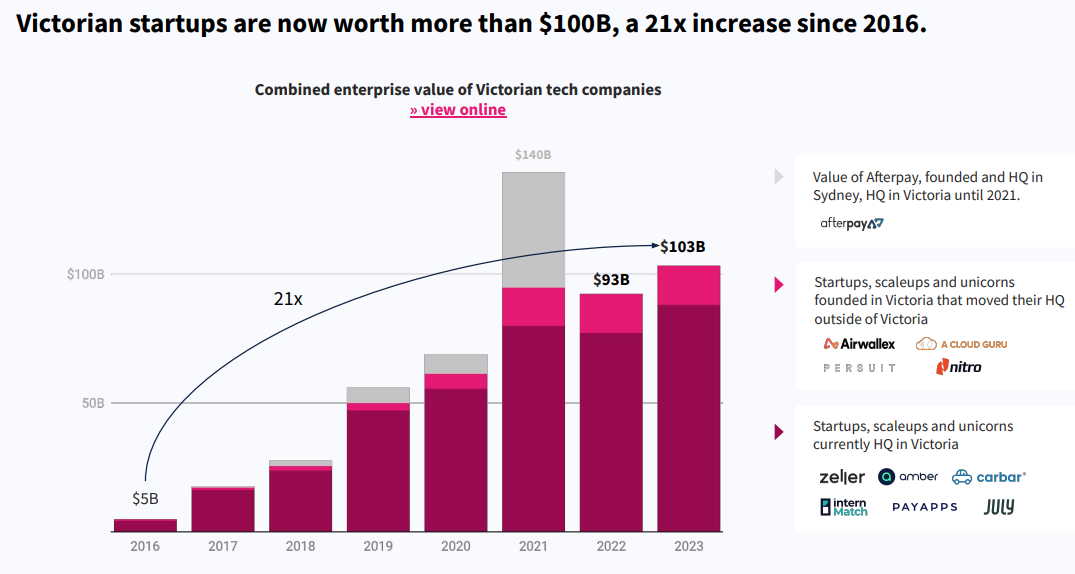

In an early holiday present to the state’s startup ecosystem, the Thursday report states Victorian startups are now cumulatively valued at $103 billion, a valuation that has grown a phenomenal 21 times over since 2016.

The report takes a broad view of what constitutes a Victorian startup: early-stage firms and scaleups founded since 2003 are included, along with the billion-dollar-plus unicorns founded in Victoria since 1990.

That means the data includes well-established industry titans like REA Group, SEEK, MYOB, and Carsales, along with newer players like Judo Bank, Zeller, Airwallex, Linktree, and Envato.

The value of Victoria’s startup ecosystem over time. Source: LaunchVic

The Victorian scene now contributes to 35,600 jobs across Australia, with 7,200 of those jobs contained within the eight unicorns founded pre-2003.

Additionally, the state’s startups are responsible for a further 20,400 jobs abroad.

Fintech is the biggest job-creator, followed by the healthtech market.

Although the top-line figures are worth celebrating, the report also outlines where the Victorian scene could perform more strongly.

More than 1,000 Victorian enterprises founded since 2003 have received investment from venture capital firms, with 25% of those raising at least $5 million.

Globally, 30% of VC-backed startups raise at least $5 million, according to the report, suggesting a shortfall in funding opportunities domestically.

In a statement, LaunchVic CEO Kate Cornick said that data is worth contemplation.

“Early-stage investment continues to be a concern for LaunchVic, as it is essential startups get capital to support their early growth,” she said.

“It is pleasing to see the work we have done to bring new investors into the startup sector pay off; however, we remain laser-focused on increasing access to early-stage capital.”

LaunchVic itself has introduced a number of funding schemes in 2023 to help bridge that gap, including a $1 million fund for agtech startups, and $5 million for the Alice Anderson fund.

The report also outlines difficulties towards the end of a startup’s independent lifecycle.

Fifteen percent of Victorian VC-backed firms since 2003 have had an exit via strategic sale, buyout, or IPO, compared to 30% of comparable startups worldwide, it states.

You can read the report here.

Handpicked for you

Eleven Aussie AI startups we’re excited to watch in 2024

COMMENTS

SmartCompany is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while it is being reviewed, but we’re working as fast as we can to keep the conversation rolling.

The SmartCompany comment section is members-only content. Please subscribe to leave a comment.

The SmartCompany comment section is members-only content. Please login to leave a comment.