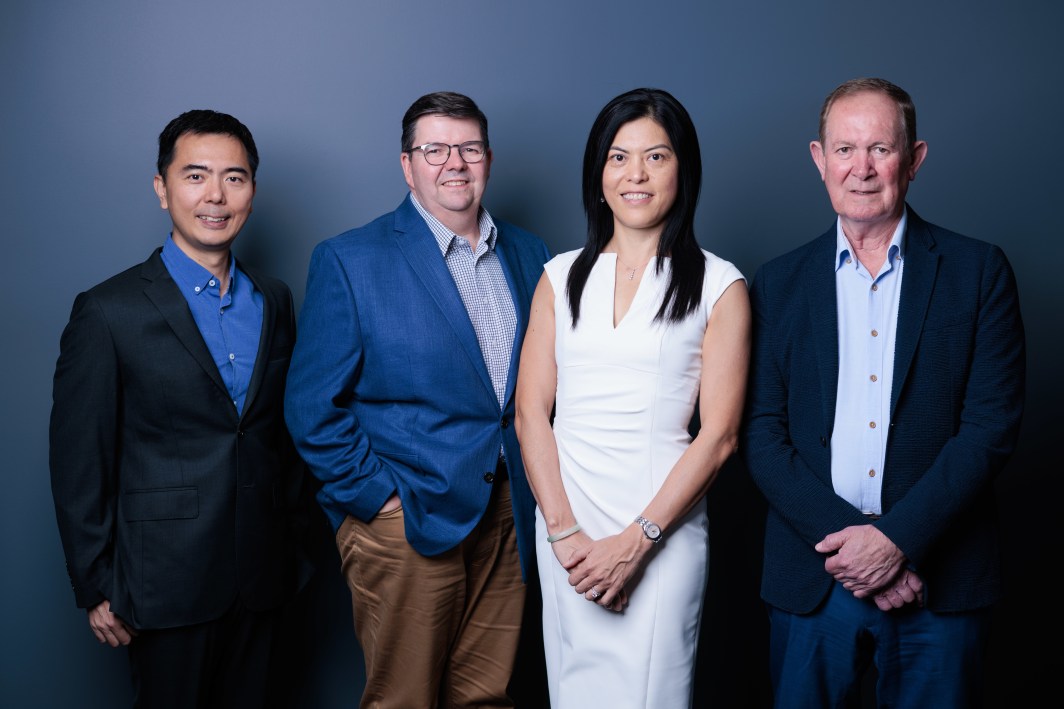

The Revsu team. Source: Supplied

The startup funding announcements are coming thick and fast as the calendar year quickly draws to a close, with AI startups, fintechs, property management platforms and even a company building a neural implant raising funds this week.

Here’s 11 Australian startups set for their next stage of growth.

Rich Data Co: $28 million

L-R: Charles Guan, Gordon Campbell, Ada Guan and Michael Coomer. Source: Supplied

Sydney-based AI decisioning startup Rich Data Co plans to accelerate its expansion into North America, after successfully completing a $28 million (US$17.5 million) capital raise.

Rich Data Co was founded by Charles Guan, Gordon Campbell, Ada Guan and Michael Coomer in 2016. Its platform uses artificial intelligence (AI) to give banks better insights into the behaviour of borrowers, which in turn helps them to make more accurate and efficient lending decisions to businesses.

The Series B round was led by Australian Big Four bank Westpac and NASDAQ-listed cloud banking firm nCino, both of which have been using Rich Data Co in their lending operations. The round also included reinvestment from Australian funds management firm BMYG and a contribution from new Singapore-based investor Octava Fund.

In a statement, Rich Data Co said it has been expanding into North America over the past 18 months and the new funding will accelerate this push.

“With this investment, we are strengthening our relationship with Westpac and deepening our partnership with nCino,” said Ada Guan, CEO and co-founder of Rich Data Co.

“Securing such a significant amount of investment within challenging fundraising conditions speaks to the opportunity that Rich Data Co’s AI decisioning platform offers the industry, which is pleasingly being recognised by our investors.

“Now that the B round has closed, we can get on with doing what we love to do and that is disrupt current lending approaches and grow our industry leadership in the exciting AI decisioning space.”

WLTH: $14 million

WLTH co-founders Brodie Haupt and Drew Haupt at a beach cleanup. Source: Supplied

Queensland fintech WLTH has closed a $14 million funding round and acquired fellow Queensland firm, Mortgage Mart of Australia, in a cash and equity deal valued at more than $10 million, reports the Australian Financial Review.

WLTH is a digital lender and payments company founded in Brisbane in 2019 by serial entrepreneurs Brodie Haupt, Drew Haupt, Darren Hodgkin and John Kerr.

The fintech has a particular focus on sustainability and has committed to cleaning up 50m² of the Australian coastline for every mortgage settled. In late 2022, it even launched the WLTH Parley Ocean Card — a Visa card made from upcycled plastic waste collected from beaches and coastlines.

Its latest funding injection comes from cornerstone investors, Melbourne-based Rajomon, and ASX-listed Kina Bank, which is based in Papua New Guinea.

The startup previously secured $3 million in seed funding in July 2021.

WLTH said in a statement that Mortgage Mart of Australia has more than $1 billion in its loan portfolio, and following the acquisition, WLTH’s loan book will exceed $1.5 billion.

The startup plans to continue operating the brands separately. Mortgage Mart co-founder Wayne Armstrong is expected to stay with the business as general manager, with his co-founder Doug Daniel to join the company’s board.

“The acquisition of Mortgage Mart brings us significantly closer to achieving our goal of making homeownership more accessible and affordable for all Australians,” said WLTH co-founder Brodie Haupt in a statement.

“Together, we aim to create a powerful force in the Australian mortgage market, providing brokers and their customers with a compelling alternative to the traditional banks.”

Nexl: $6.6 million

Nexl founder Philipp Thurner. Source: Nexl

Legal-tech startup Nexl has raised $6.6 million in fresh funding in a round led by Shearwater Capital, and participated in by existing investor EVP.

The raise comes only six months after Nexl raised $4 million that valued the startup at $31 million, according to the Australian Financial Review,

Nexl was founded by ex-Gilbert+Tobin executive Philipp Thurner in 2019 and has pivoted from its initial goal of being a “LinkedIn for Lawyer” to now providing customer relationship management (CRM) software to law firms.

Gilbert+Tobin is among the law firms to be using the Nexl platform, along with the likes of MinterEllison. The startup is on track to reach $4 million in annual recurring revenue, according to the AFR.

Nexl says it plans to use the funding to “slow down” and focus on strategic growth plans in Australia, Europe and the US.

Resvu: $4 million

The Revsu team. Source: Supplied

Adelaide-based strata management startup Resvu has celebrated a successful launch into the US, after raising $4 million in October and bringing its total funding raised in just over 12 months to $7 million.

Resvu now has more than 40 investors, said chair Richard Hockney in a statement.

“These funds will play a pivotal role in further developing Resvu’s presence in the US market, significantly strengthening our sales and marketing teams,” he said.

Resvu has developed a customer service experience platform for the community and strata management sector, as well as a homeowner mobile app. Together, the startup’s products aim to create a more collaborative and transparent relationship between strata managers and residents, and according to the company, are used by more than 700,000 homeowners globally.

The startup was founded by CEO Tom Welsby in 2017, and draws on his own experience as a former strata manager.

“There was a serious lack of strata manager wellness…and I soon realised that many of the triggers could be removed and a measure of a healthy work-life balance regained. Key among these were the hundreds of time-consuming administrative emails and phone calls they had to deal with each day,” he said.

Stropro: $3 million

The founders of Stropro. Source: Supplied

Fintech Stropro successfully completed a $3 million funding round, led by Leslie Szekely from EVP, in November.

Also participating in the round were Matt Browne from Blacknova Venture Capital, Dale Holmes from Spire Capital and Seedspace Venture Capital.

Stropro is an end-to-end alternative investment platform, designed specifically for private wealth advisers, family offices, corporates and treasuries. It offers access to investments at all risk levels, and its offerings include defensive institutional deposits, global private equity or credit funds, tailored structured products and global venture capital funds.

The company was founded in 2018 by former Citi adviser Anto Joseph, private banking client Rob Nicholls, financial product specialist Ben Streater, and serial tech entrepreneur Abraham Robertson.

The startup told SmartCompany it has recorded some $300 million in inflows since January 2020, including $80 million in the last 2 months.

It plans to put the new funding towards delivering on a number of distribution partnerships. This includes integrations with major wealth management platforms, such as Sharesight, to offer a broader range of alternative investments.

EnvisionVR: $2.6 million

A virtual reality startup that allows property builders and developers to walk through off-the-plan developments has raised $2.6 million, reports Startup Daily.

Founded by CEO Michael Shaw in 2019, the startup’s funding comes from unnamed industry leaders, according to reports.

The startup provides a mobile platform with virtual and augmented reality capabilities to allow users to easily visualise a new home or property development. The goal is to eliminate some of the high holding costs associated with off-the-plan property developments across the country.

The proptech startup has reportedly showcased and sold more than $500 million worth of property on the platform in the past 18 months.

“We wanted to deliver the highest quality AR/VR experience and now anyone can visualise their future home using a mobile phone, tablet, VR headset or the web,” Shaw told Startup Daily.

“Whilst there are a number of solutions on the market, these are either tethered or have to be viewed on high-powered computers. EnvisionVR is bringing virtual experiences directly to people through their own devices.”

The funding is earmarked for the startup’s ongoing international expansion, including its work with CGI studios around the world.

Soho: $750,000

Jonathan Lui of Soho. Source: Supplied

A property startup founded by Airtasker co-founder Jonathan Lui says it is now valued at $20 million, following a $750,000 capital raise.

Lui launched property management startup Soho in 2017, likening it to“LinkedIn for property” at the time.

The startup, which allows property owners to create online profiles for their houses, complete with rental history, sales prices, and investment performance metrics, raised $1 million in 2017 and followed that up with another $1.65 million raise in 2018. To date, Soho has raised more than $8 million in capital.

The latest pre-Series B round comes from Singapore venture capital fund Feedback Ventures, and comes ahead of a larger Series B round planned for 2024. The funds will go towards accelerating the startup’s AI-based real estate insights platform.

More than 150,000 properties are now featured on Soho, which has a presence in all Australian capital cities, as well as key regional areas.

“With 2023 being our strongest year and soon coming to a close, 2024 is already shaping up to be an incredible year for Soho with several partnerships and AI products being launched for property seekers and real estate agents alike,” said Lui in a statement.

Levin Health: $947,897

Source: Levin Health

More than 400 investors have backed medicinal cannabis startup Levin Health to the tune of more than $940,000 via an equity crowdfunding campaign on Birchal.

Levin Health is developing cannabis products to help with the treatment of chronic pain, poor sleep and anxiety, with a particular focus on the sporting arena. The company is led by managing director Mark Brayshaw, a former AFL footballer and executive, and has an advisory board made up of leading Australian athletes, including basketballers Lauren Jackson and Andrew Bogut and jockey Damien Oliver.

According to Levin Health’s Birchal profile, the company reached $5.2 million in sales in the last financial year and close to 500 healthcare professionals have prescribed one of its products.

The company plans to use the funds raised to build up its inventory and undertake further clinical trials.

Bunsters: $649,800

Renae Bunster and her range of Bunsters products. Source: supplied.

Hot sauce brand Bunsters completed its Birchal equity crowdfunding campaign this week, locking in almost $650,000 from 371 investors.

Founded by Renae Bunster in 2014, the brand initially built a solid following for its Shit the Bed Hot Sauce and secured shelf space in hundreds of independent supermarkets around the country.

Now, the brand has found its way into Woolworths supermarkets and says “2024 is set to be our breakthrough year”.

The latest equity crowdfunding campaign was Bunsters’ third, and the company has raised a total of $3.9 million over the three campaigns.

It also attracted a high number of return investors at 46%, which compares to an industry norm of around 6% for companies undertaking subsequent Birchal raises.

“The funds we’ve raised in this campaign will fuel Bunsters’ rapid expansion in Woolies and open doors to new export markets, particularly in the USA and worldwide,” said Renae Bunster in a statement.

“We’ve wasted no time in appointing a new US distributor and sales force, setting the stage for a big period of growth next year.”

Carbon Cybernetics: $480,000

Neural implant startup Carbon Cybernetics has raised $480,000 in pre-seed investment from the University of Melbourne, while also appointing Justin Spangaro as its new CEO.

Born out of Melbourne University’s School of Physics, Carbon Cybernetics is developing a brain-machine device to help treat epilepsy and other serious neurological conditions. The device will allow clinicians to provide more effective therapies to patients by producing streams of high-resolution data that allows them to record individual neurons in the patients’ brains.

The new funding will be used to help the startup commercialise the devices and undertake pre-clinical activities ahead of an early feasibility in-human study.

Serial entrepreneur Spangaro has taken over as CEO from the startup’s founder David Garrett, who will serve as the Carbon Cybernetics chief technology officer.

Spangaro was previously the Australian managing director for AI semiconductor startup Wave Computing and has served as CSIRO’s entrepreneur-in-residence.

“I am always looking for ways that technology can improve lives and create the future and this is a perfect example,” Spangaro said in a statement provided to SmartCompany.

“For somebody that cannot care for a loved one, drive a car or go out with their friends, the power to prevent a seizure will be life-changing. I am privileged to join such a capable team and cannot wait to share this remarkable device with the world.”

Beneficial Beer Co: $475,891

Also successfully raising via Birchal this week was Beneficial Beer Co, which has secured $475,891 from 178 investors for its “non-alcoholic beer that’s brewed for humankind”.

Brewed using solar power and committed to making non-alcoholic beers that “taste like the real deal”, the company has brewed more than 75,000 litres of beer since it was founded in 2022; featured in Aldi and Coles Liquorland; and begun exporting to New Zealand.

Over the next 12 months, it hopes to continue this momentum by expanding its sales team, employ a full-time marketing resource, build out its e-commerce platform, and add more products to its range.

Handpicked for you

Tractor Ventures launches 24-hour lending approvals, plans equity fund for 2024

COMMENTS

SmartCompany is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while it is being reviewed, but we’re working as fast as we can to keep the conversation rolling.

The SmartCompany comment section is members-only content. Please subscribe to leave a comment.

The SmartCompany comment section is members-only content. Please login to leave a comment.