The Australian Taxation Office (ATO) is accelerating its use of company wind up applications, risk reporting firm Alares says, suggesting the return to pre-pandemic compliance measures is well and truly underway.

In its Tuesday data briefing, Alares stated the ATO issued 13 company wind up applications over the last week, marking the highest weekly total since 2019.

In addition, the ATO issued 17 new winding up applications across August — which Alares states is nearly equal to the total number of applications the tax office had issued over the past two years.

All told, the ATO’s use of company wind up notices is still far below the historical average of roughly 40 orders each week.

But its decision to increase the use of one of the most powerful tools in its compliance arsenal indicates the time for pandemic-era leniency is rapidly coming to a close.

The ATO has already leaned into the use of director penalty notices to reach company directors with outstanding tax obligations, sending out as many as 40 a day in May.

And in a Q&A posted on the ATO website last week, new deputy commissioner of small business Will Day signaled the tax office is prepared to ramp up its collection efforts.

“I think most people in the community would understand that the ATO has an obligation to collect what it is owed,” Day said.

Backdropped by increasing ATO action, and the absence of stimulus measures which temporarily kept struggling companies above water, company collapses are now growing in frequency.

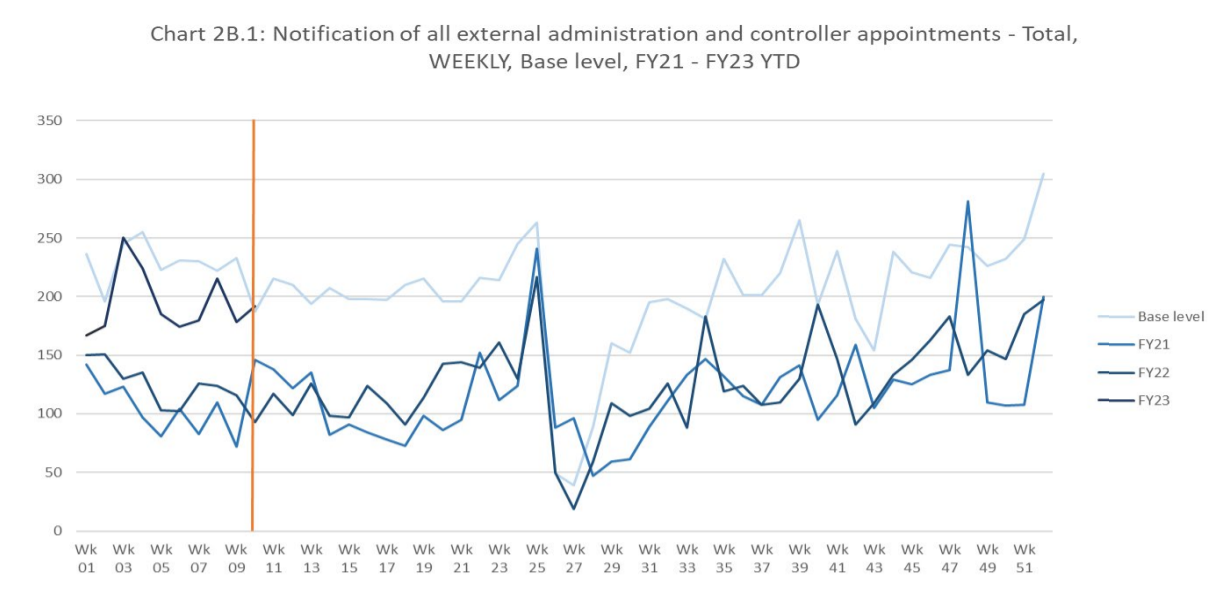

The latest Australian Securities and Investments Commission (ASIC) data shows 192 external administration and controller appointments were recorded in the week commencing September 2, more than double the 93 recorded in the same week last year.

The number of appointments is now nearing baseline levels, the data shows, after two years of pandemic-linked suppression.

Source: ASIC

Handpicked for you

New ATO small business chief offers olive branch to SMEs after leading raids on suspected GST fraudsters

COMMENTS

SmartCompany is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while it is being reviewed, but we’re working as fast as we can to keep the conversation rolling.

The SmartCompany comment section is members-only content. Please subscribe to leave a comment.

The SmartCompany comment section is members-only content. Please login to leave a comment.