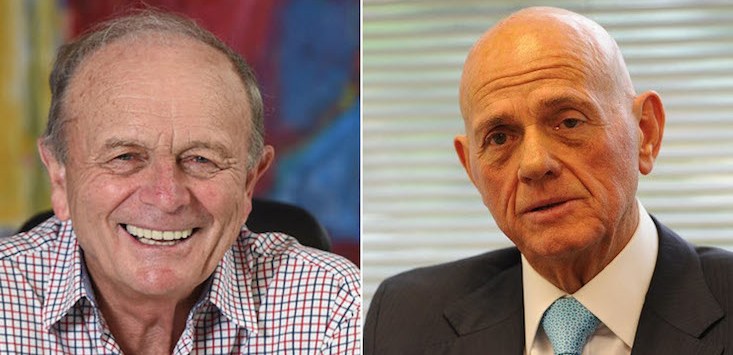

Gerry Harvey (left) and Solomon Lew (right). Source: Harvey Norman/AAP.

Compared to the UK and the US, Australia has an unusually large number of billionaires who hold the majority of their wealth in public companies listed on the ASX.

After 50 years of wheeling and dealing, Kerry Stokes is near the top of the pile given that his 58.5% stake in Seven Group Holdings is now worth $4.59 billion. The Australian’s Rich List valued him at $7.26 billion earlier this year.

Stokes is unique in many respects, particularly given that he was an orphan whose wealth is entirely self made. He’s also the only Australian billionaire who has a $1 billion-plus personal investment in more than one public company, courtesy of the $1.7 billion stake that Seven Group Holdings owns in Boral.

Virtually all of the other billionaires on the following list were founders, whereas Stokes never started a business that floated on the ASX. He prefers to successfully launch raids on public companies, such as Seven, WA News, Beach Energy and Boral.

Most valuable stakes owned by individuals in ASX listed companies

Fortescue Metals: Twiggy Forrest’s 36.25% stake is worth $24.1 billion

Reece: the Wilson family’s 67.7% stake is worth $8.8 billion

Seven Group Holdings: Kerry Stokes’ 58.5% stake is worth $4.59 billion

WiseTech: Richard Wise’s 44% stake is worth $4.11 billion

Crown: James Packer’s 36% stake is worth $2.95 billion

Harvey Norman: Gerry Harvey’s 31.5% stake is worth $2.25 billion

Afterpay: Antony Eisen and Nicholas Molnar each own 17.95 million shares worth $2.18 billion

TPG: David Teoh’s 17.12% stake is worth $1.874 billion

Premier Investments: Solly Lew’s 42.43% stake is worth $1.57 billion

Vicinity Centres: John Gandel’s 15.2% stake is worth $1.02 billion.

This article was first published by Crikey.

Handpicked for you

A six-step strategy for lobbying government: Kate Carnell and Jo Scard give the inside account

COMMENTS

SmartCompany is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while it is being reviewed, but we’re working as fast as we can to keep the conversation rolling.

The SmartCompany comment section is members-only content. Please subscribe to leave a comment.

The SmartCompany comment section is members-only content. Please login to leave a comment.