Source: Pexels/Karolina Grabowska.

The Reserve Bank of Australia (RBA) has given breathing room to the major banks and payment service providers failing to promote least-cost routing among merchants, saying they have until June 2024 to boost merchant uptake before facing a regulatory crackdown.

Least-cost routing (LCR) allows merchants to process contactless debit card transactions through the payment pathway of their choosing, instead of the default pathway set by their bank or payment service provider.

This means merchants can opt to process payments through the EFTPOS system, which often levels cheaper transaction fees compared to the competing Visa and Mastercard payment systems.

The cumulative effect of those lower transaction fees can have significant financial benefits for merchants in the long term, industry advocates say.

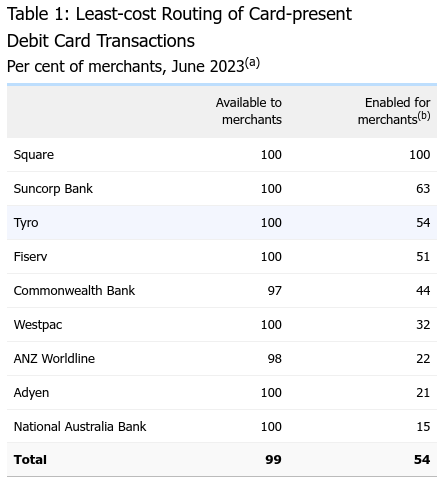

LCR for card transactions is available to nearly all merchants which use Commonwealth Bank, ANZ, NAB, and Westpac as payment service providers.

But new data from the RBA shows a relatively low uptake for LCR among those banks’ merchant customers.

When including other major payment service providers like Suncorp, Square, and Tyro, only 54% of merchants had LCR enabled in June this year, the RBA said.

Source: Reserve Bank of Australia

“Formal regulatory requirement” a possibility if numbers don’t rise

Despite that figure only changing “marginally over the year”, the RBA’s Payments System Board on Thursday resolved to give the banks and payment services providers another ten months before considering regulatory action.

“The Board expects providers to make faster progress on enabling LCR for merchants that could benefit from it,” the RBA said.

“If substantial progress is not made by June 2024, the Bank will explore a formal regulatory requirement to enable LCR.”

Further, the RBA also resolved not to move forward with a potential ban on ‘default’ routing networks, a proposal the central bank first put forward in May while fretting that LCR takeup was too low among merchants.

“Based on industry feedback gathered during a recent public consultation, the Board decided that it would not further explore prohibiting card schemes and issuers from setting a default routing network on dual-network debit cards,” the RBA said.

“Feedback indicated that such a prohibition could result in failed transactions and require a costly reissuance of all debit cards.

“The Board, however, remains strongly supportive of merchants having the ability to choose their preferred debit card network through least-cost routing.”

Online transaction LCR falling behind

More broadly, industry takeup of LCR in circumstances where a card was not provided — in other words, online transactions — has also fallen shy of the RBA’s expectations.

“The industry largely did not meet the RBA’s expectation that all acquirers, payment facilitators and gateways offer and promote LCR functionality to merchants in the online (card-not-present) environment by the end of 2022,” the RBA said.

“Only a few providers have made LCR widely available to their merchants for online transactions as at the end of June 2023.”

Handpicked for you

Easing labour market may spell good news on interest rates

COMMENTS

SmartCompany is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while it is being reviewed, but we’re working as fast as we can to keep the conversation rolling.

The SmartCompany comment section is members-only content. Please subscribe to leave a comment.

The SmartCompany comment section is members-only content. Please login to leave a comment.