One in four personal insolvencies recorded in June were business-related, according to provisional government data, as officials and bankruptcy professionals alike prepare for insolvencies to rise over the next year.

The Australian Financial Security Authority (AFSA) released its latest data snapshot on Monday, detailing how personal insolvency numbers — that is, the number of individuals formally declaring they cannot repay their debts when they are due — changed from the end of May.

The data also captures how the personal finances of entrepreneurs can become intertwined with their business endeavours, in a way not captured by company insolvency statistics alone.

AFSA tallied 901 new personal insolvencies in June, a slight downturn from 1,031 recorded in May.

Of those 901 personal insolvencies, 226, or 25%, were business-related, where the insolvent individual operated as a sole trader, in a partnership, or as a company director.

The overall figure also included 501 personal bankruptcies, and 197, or almost 40%, were deemed as business-related.

AFSA also recorded 392 debt agreements, of which 22 were linked to business, and seven personal insolvency agreements, all of which had business ties.

The findings echo corporate insolvency statistics that show major hardship in the construction sector.

Where AFSA could determine the industry an insolvent individual worked in, the most common industries were construction, followed by retail trade, and accommodation and food services.

Personal insolvency figures set to rise from historic lows

Personal insolvency rates are currently hovering around historically low levels of about 10,000 a year, while the 10-year average is closer to 25,000 a year.

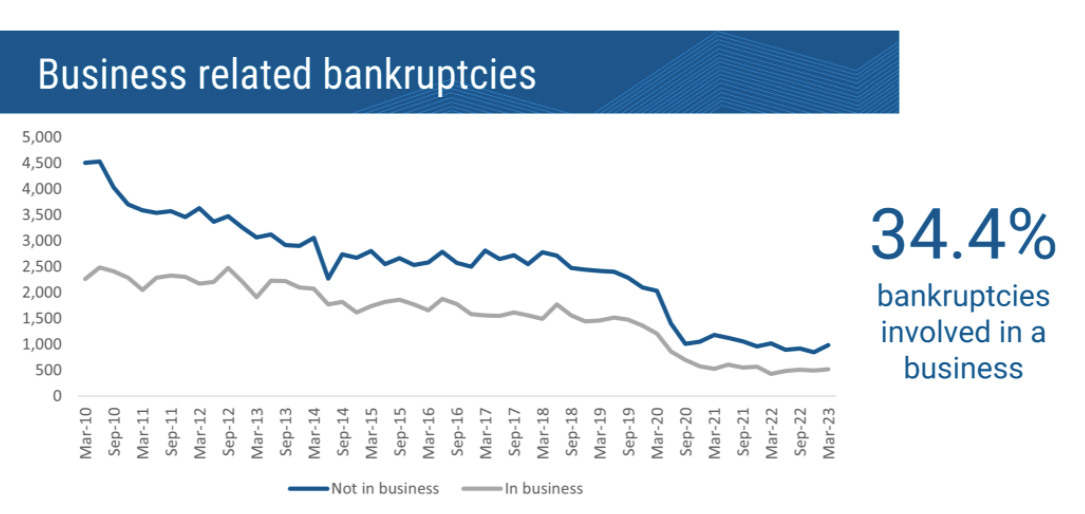

Business-related personal bankruptcy statistics through to March 2023. Source: AFSA

Although personal insolvency figures took a slight dip between May and June, experts anticipate those numbers to rise considerably over the next year.

Speaking before the Association of Independent Insolvency Practitioners in July, AFSA chief executive Tim Beresford said he expected personal insolvency numbers to climb due to a number of policy and macroeconomic factors.

The Hayne Royal Commission, which drilled down on loose lending standards, “changed creditor behaviour”, Beresford said.

Average figures over the past two years were “clearly” affected by the leniency offered to debtors through the COVID-19 crisis, he added.

As those pandemic-era payment extensions and repayment holidays come to an end, Beresford said he expects personal insolvency numbers to rise considerably over current next financial year.

“Over the next 12-18 months, we’re likely to see numbers heading back towards the 10-year average,” he said.

“Our prediction for 2023-2024 is an increase to 14,000 personal insolvencies.”

Business-related debts a major component in overall system load

That uptick is sure to increase the business-related debt burden, too.

Although business-related insolvencies do not make up the majority of personal insolvencies by number, their associated debts dramatically overshadow individual debts.

In January, AFSA noted that business-related personal insolvencies accounted for $11.4 billion, or roughly two-thirds, of debt in the system.

“The average debt for a business-related personal insolvency is $830,502 – over 5.8 times larger than a non-business-related personal insolvency ($141,733),” it noted.

Individuals struggling with their business-related debts can contact the free Small Business Debt Helpline on 1800 413 828 or online.

Those concerned about meeting their tax obligations can contact a local tax training clinic for help, or the Australian Taxation Office directly.

Handpicked for you

Outgoing ATO head Chris Jordan vows to keep foot on the pedal in final months

COMMENTS

SmartCompany is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while it is being reviewed, but we’re working as fast as we can to keep the conversation rolling.

The SmartCompany comment section is members-only content. Please subscribe to leave a comment.

The SmartCompany comment section is members-only content. Please login to leave a comment.