Victorian budget: Small businesses get payroll tax relief, but big businesses will pay more

The Andrews Labor government says it plans to make payroll tax “fairer” for Victorian small businesses by lifting the payroll tax-free threshold in two stages over the next two years.

Apple Pay just dismantled the control of banks and giant cards over merchants

Apple’s basic game plan this time is to get in ahead of the banks and regulators by using the iPhone’s tap-payments acceptance capability to open the market.

New ATO scheme will pay small retailers to report their GST monthly

The Australian Taxation Office will pay twenty small retailers to report and lodge their GST obligations on a monthly cycle, as it investigates new ways to improve tax performance among local SMEs.

BNPL products like Afterpay will now have similar regulation to credit cards

After years of scrutiny, BNPL products such as Afterpay will now be regulated under The Credits Act. Assistant Treasurer Stephen Jones announced the move on Monday.

No hiding the side hustle: ATO launches new ad campaign to boost business income tax compliance

As Australian workers hurtle towards the end of financial year, the ATO is reminding new side hustlers not to overlook business income on their tax return.

PwC tax leak: Separating corporate and public interests akin to separating church and state

The power of the modern consultants, like PwC, to influence government is akin to the influence Church officials once wielded.

Apple’s iPhone ‘tap to pay’ system hits Australia, as SMEs weigh up fees and trust concerns

Australian small businesses can now accept payments directly through their iPhone, promising greater mobility to traders while upheaving the highly competitive point-of-sale (POS) market.

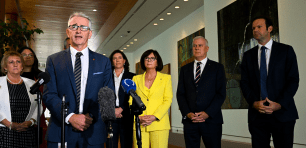

PwC internal inquiry under fire as government plans stricter review on the use of consulting firms

A company director will review the culture of embattled accounting firm PwC as the federal government works out how to deal with the consequences of the tax leak scandal.

More than 650 branches since 2017: Banks continue to leave regions despite billion-dollar future

An inquiry is examining the impact of accelerated bank closures across country Australia and will hear from councils and banks alike.

How small businesses and their employees can both win as cost of living pressures rise

The key lies in levelling with your employees, working with and supporting them, so you reduce the risk of a mass exodus when you come out the other side.

ATO reveals tax-time hitlist, cracking down on dodgy WFH claims and capital gains errors

The Australian Taxation Office (ATO) has revealed its priority hit-list for the end of financial year period, reminding workers and businesses to stay on top of their work-related expenses and potential capital gains requirements.

A major minimum wage hike and impending super increase will hammer small businesses, industry representatives fear

The federal government has maintained its call for the national minimum wage to move in line with inflation, heralding the possibility of significant back-to-back increases flowing through to small business employers.