Thousands of business owners in northern NSW faced a brutal clean up in the aftermath of the floods in early 2022. Source: AAP Image/Jason O'Brien

Some small businesses are watching their insurance premiums rise by 30% year-on-year, industry advocates say, as KPMG projects double-digit increases over the next twelve months.

Data compiled by the professional services firm recorded rising business coverage costs in the year to March this year.

Speaking to The Australian, Scott Guse, insurance partner at KPMG, said he expected the cost of insurance premiums to increase at least 10% over the next year.

But some small businesses are already facing year-on-year increases of 30% and above, said Luke Achterstraat, CEO of the Council of Small Business Organisations of Australia (COSBOA).

“Anecdotally, in some sort of outlier cases, you’re actually seeing increases even potentially slightly beyond that,” Achterstraat told SmartCompany on Monday.

Alongside the cost of energy, rent, and interest rates, maintaining insurance is “a real monetary cost and a real financial strain for small businesses at the moment,” he said.

Why are insurance costs rising?

The increasing frequency and intensity of natural disasters is a significant driver of insurance premium increases.

Severe flooding across the east coast in February and March 2022 cost Australian insurers at least $5.65 billion, becoming the most costly natural disaster in Australian history.

“Many of our members are talking about the impact of extreme weather events in driving up costs, and limiting coverage for certain sectors as well,” Achterstraat said.

Some insurers say vulnerabilities in Australia’s disaster mitigation practices have also left businesses and homes exposed, further pushing up the cost of coverage.

At the same time, inflation is driving the cost of repairs for damaged goods and property, making it costlier for insurers to offer fixes and like-for-like replacements.

Achterstraat said one way for small businesses to potentially lower their premiums is to present a detailed and robust risk mitigation plan to their insurer.

Shopping around for the right coverage can also eke out savings, especially given the complexity of some policies.

Insurers could also help by making sure their policies are “fit for purpose” for SME clients, he added.

While COSBOA is yet to establish a formal position on government co-contributions to insurance premiums, Achterstraat said such “extraordinary measures” could provide short-term relief to struggling SMEs.

“There might be a role for government to consider what sort of co-payments, or accelerated write-offs, or things of that nature could be applied,” he said.

How much are some premiums increasing?

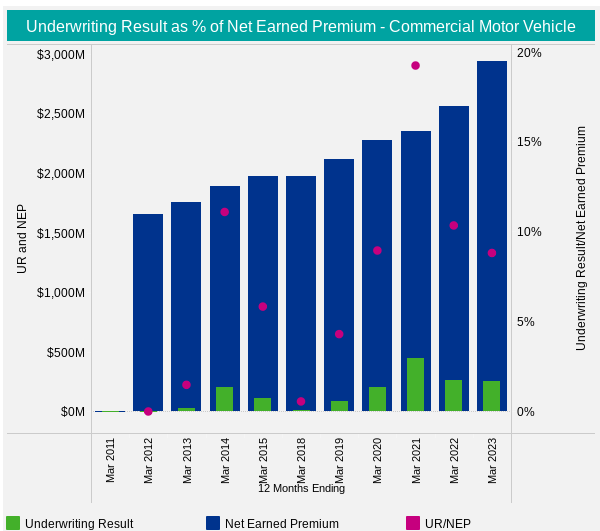

The KPMG data shows how average premium costs for a number of business insurance products rose dramatically over the past year.

In the twelve months to March 2023, the average quarterly premium for commercial vehicle insurance was $1,825, compared to $1,657 in the year to March 2022.

Employers’ liability insurance hit a quarterly average of $15,434 in the twelve months to March 2023, compared to $14,076 in the prior corresponding period.

Gross written premiums — the value of insurance contracts before taxes, sales commissions, and the cost of reinsurance are taken into account — also soared over the past year, including for commercial vehicles and employers’ liability coverage.

At the same time, profit margins appear to be tightening for insurers in some key policy areas — suggesting some payouts are climbing alongside premiums, punishing the operating margins of insurers and potentially leading to increased costs being passed to consumers.

One key indicator is the underwriting result — that is, net premium revenue minus paid-out claims and other underwriting costs.

For commercial vehicle insurance, the underwriting result in the year to March 2023 was 8.79% of net earned premiums.

The underwriting result was 10.32% in the year to March 2022, despite overall net earned premiums being much higher in 2023.

Source: KPMG

What should happen next?

That financial data is backdropped by the real-world consequences of natural disasters, as evidenced by the catastrophic damage of last year’s flooding and the horrific bushfire season of 2019-2020.

In March, KPMG said increasing resilience to natural perils would be the insurance sector’s top priority in 2023.

“To enhance the country’s resilience against such events, insurers are encouraging government action to reduce both the risk and exposure,” KPMG said.

Lawmakers appear to be listening.

Australian governments have committed $1 billion over five years to resilience and risk-reduction projects through the Disaster Ready Fund, with the goal of supporting communities at risk of flooding, fire, and other catastrophes.

Separately, the 2023-2023 federal budget includes new resilience measures like $236 million over the next 10 years to improve flood forecasting systems.

The insurance sector has welcomed measures like the Disaster Ready Fund, and its potential to lower premiums for vulnerable businesses and households.

“The cost of worsening extreme weather is impacting the affordability and availability of insurance in some parts of Australia, and we know a key lever to improving insurance outcomes is reducing or mitigating the risk that is present,” said Insurance Council of Australia CEO Andrew Hall.

Achterstraat said resilience funding should be tailored to protect vulnerable small businesses, particularly in disaster-prone communities.

“What we’re saying to government on that front, with the federal budget announcement, is to make sure they’re tapping into those local small businesses representatives to really ensure that they’re connecting the dots and joining up that funding with their expertise.”

Handpicked for you

Clamping down on “scamdemic”: Government’s new squad to target online fraudsters

COMMENTS

SmartCompany is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while it is being reviewed, but we’re working as fast as we can to keep the conversation rolling.

The SmartCompany comment section is members-only content. Please subscribe to leave a comment.

The SmartCompany comment section is members-only content. Please login to leave a comment.