The chief of Australia Post has repeatedly denied the beleaguered government-owned enterprise is plotting with the government to become a commonwealth-owned bank that would compete directly against the Big Four to stave off ballooning losses from its unprofitable letters business.

Fronting senate estimates on Thursday, Australia Post CEO Paul Graham was pursued by the opposition over the Community Hub at Post model, which essentially substitutes a beefed-up post office with over-the-counter banking and cash services to replace what banks that have skipped town used to offer.

A number of community advocates have been pushing for Australia Post to enter the retail banking market as a fully-fledged deposit-taking institution (ADI) to stick it to the Big Four, after major banks rapidly shuttered once extensive branch networks over the last few years, decimating the main streets of many towns in the process.

One potential model is that aside from offering the present ‘Bank at Post’ model, where counter services for other banks are outsourced to Australia Post, Australia Post would also offer its own retail banking services, which directly compete with those of established ADIs — like deposits, payments, identity services, card issuance, mortgages and loans.

Graham conceded that there are “some people raising that prospect,” but insisted that “we have had no discussions with anybody, formally or informally.”

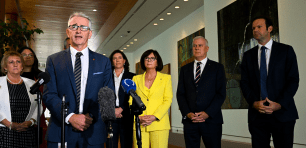

Australia Post CEO Paul Graham. Source: AAP Image/Mick Tsikas

“We are very happy to continue providing over-the-counter services [for] financial institutions — 1,150 locations in regional Australia where there are no banks and Bank at Post is the only banking facility. But we’ve had no discussions with any of those advocates,” Graham said.

Post is now in an invidious and vulnerable position courtesy of a somewhat dysfunctional political dynamic that results in its core business strategy oscillating with the government of the day, despite its core letters business rapidly becoming a financial albatross because of falling volumes.

It’s also been churning through leaders at a time when a steady, guiding hand is needed, starting with Ahmed Fahour’s exit in 2017 after criticism of his more than $5 million salary. Christine Holgate was next, skewered by then-prime minister Scott Morrison over giving her executives Cartier watches for extracting more money from the banks for delivering their counter services.

Paul Graham is the latest CEO in the hot seat, caught between a bleeding letters business that could soon require a transfusion of taxpayer’s money and demands from the Coalition that Australia Post keeps its regional footprint.

The dichotomy for the current opposition is that they seem to detest the idea that Australia Post could enter the market as a government-owned bank but can’t force the banks to stay in town, save a regional banking committee to try and shame the banks.

After being berated by Liberal senator Sarah Henderson over Australia Post’s financial performance, Nationals senator Perin Davey had another shot at teasing out any ambitions for Australia Post to become a bank.

“It has been raised with me as a concern that a Commonwealth Postal Bank would directly compete against the other financial institutions that are serviced through Bank at Post, which may see a withdrawal of their support or their arrangement with Bank at Post and [this] might limit customer choice,” Perin put to Graham.

“Have you had any thoughts on that, or has anyone made those representations to you? Or have you had conversations with the financial institutions that you have arrangements with?”

Graham said there were long-term contracts locked in with the banks (hence the Cartier watches), and that Australia Post was committed to the towns where it operated Bank at Post.

But he also revealed that there was a consideration as to whether there was still a bank in town when it came to making a call about what services were offered.

“As I mentioned in my opening statement there are 1,150 towns in Australia today where we are the only banking presence for those towns, and we will remain committed to those towns going forward,” Graham said.

One of the issues with expanding into small business services was that smaller branches were not set up for bigger volumes and dealing with cash, a somewhat ironic observation Post sold many of its older buildings set up just like a bank.

“The scope of services [is] for what we would call basic consumer banking, so the ability to deposit cash and withdraw cash. Certain limits are set and processes are in place in relation to that,” Graham said.

“Beyond that, we do not have any additional scope. That is part of the discussion that we’re having because the feedback from those communities is that small businesses have not been fully catered for.

“And also cash has not been catered for. So for example, Cooper Pedy, no more banks in town [and] about $30,000 a week in cash required that cash has to be flown in — about $7,000 each time it has to be flown in,” Graham said.

Charter flights for cash runs to prop up regional towns deserted by the banks. No wonder Post is bleeding cash, or that some reckon it should pounce on the more profitable elements of banking.

The article was first published by The Mandarin.

Handpicked for you

More than 650 branches since 2017: Banks continue to leave regions despite billion-dollar future

COMMENTS

SmartCompany is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while it is being reviewed, but we’re working as fast as we can to keep the conversation rolling.

The SmartCompany comment section is members-only content. Please subscribe to leave a comment.

The SmartCompany comment section is members-only content. Please login to leave a comment.