Source: Canva

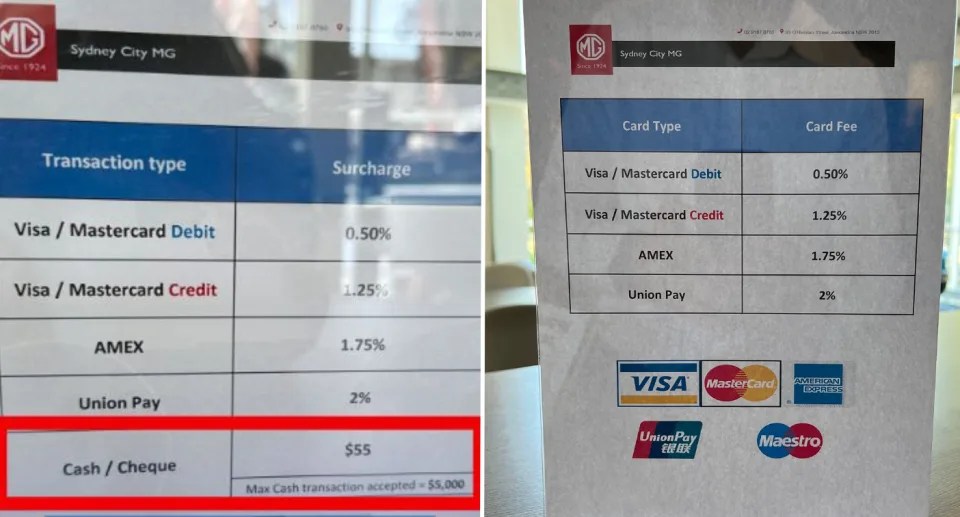

A Sydney car dealership has come under scrutiny for charging a $55 surcharge to customers paying with cash.

Sydney City MG came under fire this week when a customer discovered a $55 fee specifically for cash transactions.

“[It’s] just so over the top and a bit ridiculous,” the customer said on 2GB.

“[It’s] abusing what they can to make some extra money on the side”.

In response to the mounting concerns regarding the ‘cash surcharge’, Sydney City MG backflipped on the fee structure. The dealership said that the intended “handling fee” had been “incorrectly labelled a surcharge”.

The business said that it was put in place to counterbalance the internal costs tied to cash management. According to the business, this included having two staff members available for cash counting and ensuring the cash is “safely” moved to both the vault and the bank.

Image: 2GB

It is legal to place surcharges on cash, but there’s a catch

While businesses can apply a surcharge for specific payment methods, these are generally applied to credit cards. In these cases, the Australian Competition and Consumer Commission (ACCC) mandates that these shouldn’t exceed the business’s actual cost of accepting such payments.

According to the Reserve Bank of Australia (RBA), the average costs for different payment types are:

- Eftpos: less than 0.5%

- Visa and Mastercard debit: between 0.5% and 1%

- Visa and Mastercard credit: between 1% and 1.5%.

If a business wants to use the same surcharge percentage for all payment types, it must not be more than the lowest surcharge they would set for a single payment type. Alternatively, it can use a flat fee system instead, but this cannot exceed what it costs the business to use that payment type.

According to the RBA, a business does have a right to apply a surcharge to non-electronic payment methods — such as cash or cheques. However, a merchant is not allowed to place a surcharge across all payments. We’re also not sure that $55 would fly when credit card surcharges are strongly capped.

“It must offer at least one non-surcharged method of payment,” the RBA said.

It’s worth noting that it is not illegal for businesses to refuse cash in Australia. However, instances like this further solidify how we’re moving towards becoming a cashless society. That being said, reform is still needed to make this safe and secure. And it is happening.

Earlier this month the federal government handed down draft legislation to update the Payment Systems (Regulation) Act 1998. If passed, it will allow the RBA to regulate digital payment services such as Apple Pay and Google Pay. This has been met with mixed reactions.

It will also allow the RBA to treat these services, as well as buy now pay later (BNPL) platforms, in a similar fashion to traditional transaction types, such as credit cards.

Handpicked for you

Cash no longer king: Digital payments are taking the throne instead

COMMENTS

SmartCompany is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while it is being reviewed, but we’re working as fast as we can to keep the conversation rolling.

The SmartCompany comment section is members-only content. Please subscribe to leave a comment.

The SmartCompany comment section is members-only content. Please login to leave a comment.