Source: AAP/Lukas Coch

The most revealing graph presented in Australia’s accounts for the September quarter on Wednesday is one showing what has happened just beyond the end of the September quarter, in the one we are in now.

Melbourne’s lockdown ended on October 27.

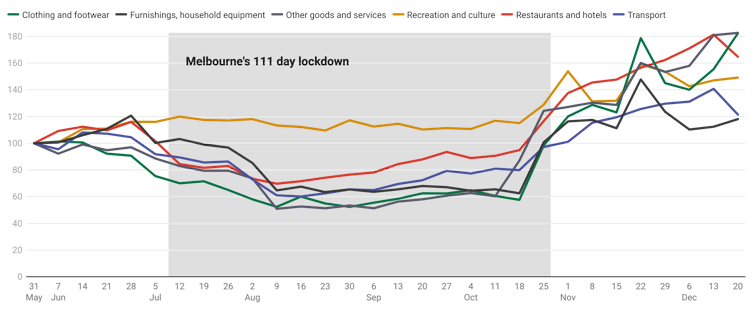

The graph uses anonymised bank account data to show what happened to spending in Victoria as soon as the lockdown was lifted.

Selected Victorian spending data

ABS

Spending on clothing, furnishings, recreation, transport and restaurants and hotels surged.

As happened after last year’s lockdowns, Victorians returned to spending pretty much what they had before.

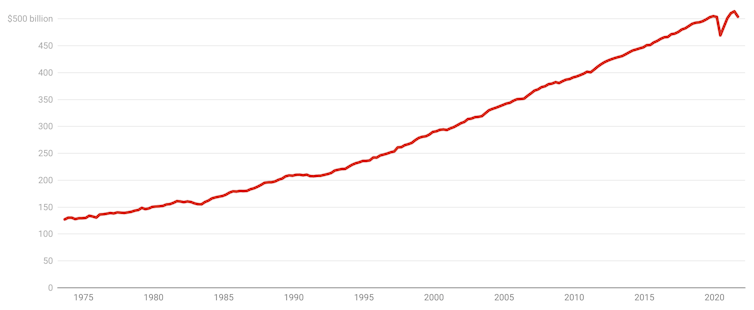

The September quarter national accounts released on Wednesday are a statement of their time — they show what things were like when NSW, Victoria and the ACT were locked down.

Australia’s gross domestic product (GDP) shrank 1.9% in the three months to September, after climbing for four consecutive quarters following the record hit of 6.8% from the first wave of COVID-19 and last year’s lockdowns.

Australian quarterly gross domestic product

ABS

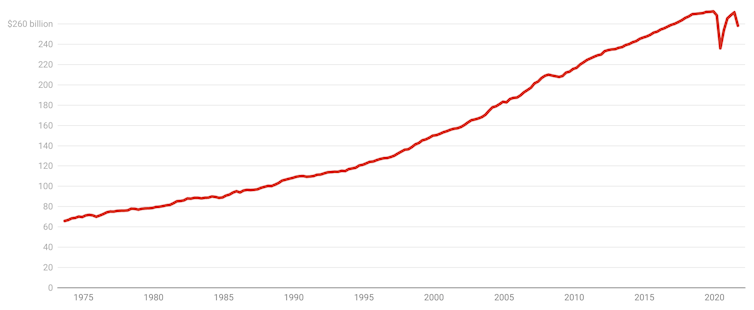

The biggest hit to GDP came from household spending, down 4.8% in the quarter.

National spending on hotels, cafes and restaurants fell 21.2%, spending on recreation and culture fell 11.8%, and spending on transport fell 40.8%.

Household final consumption expenditure

ABS

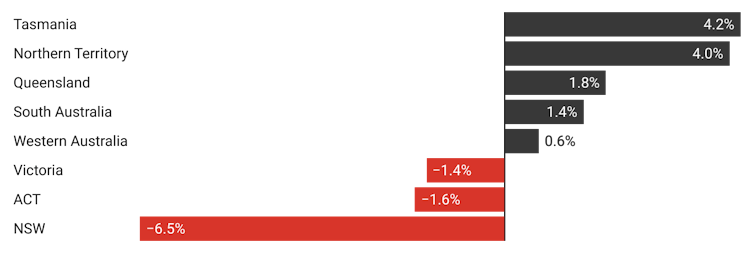

But the decline was anything but national.

Whereas spending in hotels, cafes and restaurants collapsed 33% (or more) in each of the states that were locked down, in the states that weren’t, it barely suffered.

Aggregate spending shrank 6.5% in NSW, 1.4% in Victoria and 1.6% in the ACT, while climbing strongly in the states that weren’t locked down, surging an impressive 4% in the Northern Territory and 4.2% Tasmania.

State final demand, September quarter

ABS

Nationally, personal saving soared, with the jump centred in the lockdown states as those households whose income hadn’t taken a hit saved more because of concern about the future and fewer opportunities to spend.

The national household saving rate bounded back up to an extraordinary 19.8% of household income from the 11.8% it fell to in March, after hitting an all-time high of 23.3% in the first wave of lockdowns.

Household saving ratio

ABS

The bank-sourced data on post-lockdown spending in the lockdown states suggests household saving is already on the way down.

At his parliament house press conference, Treasurer Josh Frydenberg spoke of the unusually high saving rate as a source of future spending.

“Not all of it is going to be spent,” he said. “But it’s a lot of damn money that’s been accumulated.”

If household spending had been the only thing driving changes in GDP, it would have been down 2.5%. Working in the other direction this quarter was a jump in net exports and a jump in government spending. Neither business investment nor housing construction changed much.

The Organisation for Economic Co-operation and Development forecasts released late Wednesday have the Australian economy growing 4.1% in 2022, up from 3.8% this year, slipping back to 3% in 2023.

Sustained low unemployment forecast

The OECD Economic Outlook has Australia’s unemployment rate falling to 4.7% in 2022 and 4.3% in 2023. It says as inroads are made into unemployment, wage and price pressures will build, but are expected to “remain contained”.

The organisation welcomes Australia’s commitment to net-zero emissions by 2050, but says the strategy should be “comprehensive, effective and inclusive”. Its report backs a call for an independent review of the Reserve Bank.

It forecasts global growth of 4.5% and 3.2% in 2022 and 2023.![]()

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Handpicked for you

Australia’s record job vacancies are unlikely to lead to higher wages

COMMENTS

SmartCompany is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while it is being reviewed, but we’re working as fast as we can to keep the conversation rolling.

The SmartCompany comment section is members-only content. Please subscribe to leave a comment.

The SmartCompany comment section is members-only content. Please login to leave a comment.