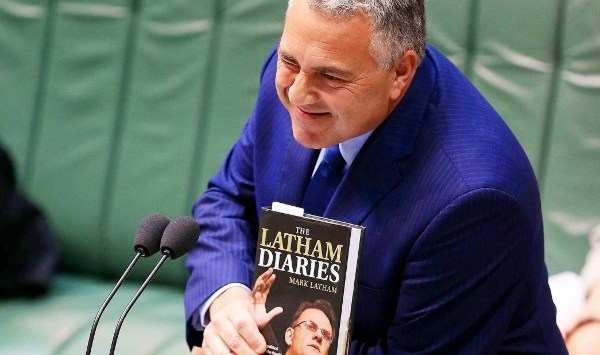

Treasurer Joe Hockey has today announced a new taskforce aimed at netting white-collar criminals, including businesses that dodge tax and commit financial fraud.

The Serious Financial Crime Taskforce will build on the work of the multi-agency Project Wickenby taskforce, which will end this year. Project Wickenby has netted $2.1 billion in liabilities since it was established in 2006.

The government will spend $127.6 million over four years on the new taskforce, which will be included in next week’s budget.

The new taskforce will be a combined effort of the Australian Taxation Office, the Crime Commission and the Federal Police, as well as a slew of other government departments.

Its focus will be to crack down on organised and serious criminal offences within the financial system, including but not limited to investment and superannuation fraud, identity crime and tax evasion.

“The Serious Financial Crime Taskforce will have an unquantifiable positive benefit on the financial wellbeing of members of the community who, without the Taskforce, may be victims of financial crime,” said Hockey in a statement.

“It will also help ensure all taxpayers pay their fair share of tax,” he added.

Peter Strong, executive director of the Council of Small Business of Australia, told SmartCompany he imagines the taskforce will set its sights on the big end of town.

“They won’t go for low hanging fruit because the value just isn’t there for them,” says Strong.

“Small businesses dodging tax need to be cracked down on, sure, but that would be a few thousand while big business could be hundreds of millions.”

Strong says the combined agency approach has been successful for the government in the past, as evidenced by Project Wickenby and other taskforces targeting organised crime, such as bikie gangs.

“When these sorts of groups get together, they normally do a good job. The more combined resources they have the better,” he says.

COMMENTS

SmartCompany is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while it is being reviewed, but we’re working as fast as we can to keep the conversation rolling.

The SmartCompany comment section is members-only content. Please subscribe to leave a comment.

The SmartCompany comment section is members-only content. Please login to leave a comment.