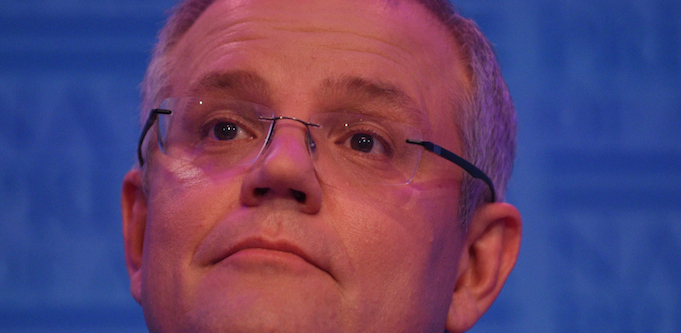

Treasurer Scott Morrison has flagged Australia’s R&D tax incentive scheme may receive a rework in the upcoming federal budget after declaring the scheme had been “taken for a ride” by some opportunistic companies.

But the threat of imposed restrictions on the popular incentive, which provides refunds for companies based on the amount they spend on research and development activities, has been met with resistance by Australian startups and startup advocacy groups, who are calling for the government to approach any changes with careful consideration.

In a speech to the AFR Banking and Wealth Summit earlier this month, Morrison told attendees that while the government recognises the benefits of fostering and investing in strong startups and new ventures, “it is not about writing blank cheques to everyone that has a good idea”.

The government is currently considering changes proposed in the 2016 R&D Tax Incentive Review for implementation in the federal budget next month. These recommendations include an annual $2 million cap for smaller companies looking to claim the R&D refund, however, a more recent report from Innovation and Science Australia suggested the cap should be $4 million.

The changes may also include a $20 million or $40 million lifetime cap for companies, according to Fairfax.

“The Turnbull Government is committed to backing in R&D investment and the economic opportunities and jobs it generates. But it is also important to ensure that the taxpayer’s significant investment in R&D, through this incentive, is generating maximum benefit for the economy and the Australian public,” Morrison said.

“This is not a tax incentive for business as usual. This incentive has been taken for a ride by some and integrity needs to be restored.

“Our focus is to relaunch an R&D tax incentive that is all about R&D additionality, things that would not have happened anyway, and rewarding the intensity of that effort.”

However, Alex McCauley, chief executive of Australia’s primary startup advocacy group StartupAus, says while he believes it’s too early to say what changes could be made through the federal budget, the value of the R&D tax incentive program to early-stage startups in Australia can’t be underestimated.

“This is the single most important program any government in any country delivers for their startups. It’s a hugely valuable program that has kept a lot of Australia’s best companies in Australia for their R&D work,” he told StartupSmart.

“It’s the best scheme of its kind in the world.”

McCauley says the R&D tax incentive does lean more towards the research rather than development, and says if the government were to make changes it should be to make more room for a focus on development and commercialisation. Caps for startups, however, should not be on the table, he says.

The scheme cost the government $2.95 billion in 2013-14, and while he recognises it’s expensive, McCauley says the reason the incentive costs the government a lot of money is because it’s “super effective”.

“It’s driving lots of new R&D, and it’s relied on heavily by the whole startup sector. The concern from the government that it’s being abused or exploited by a limited number of companies is blown out of proportion,” he says.

“The solution to that is to refocus the scheme to only be open to legitimate companies and make sure it’s policed well, not to impose restrictions.”

McCauley says StartupAus’ research has shown around 80% of R&D refunds for smaller companies is reinvested in hiring more people and fostering job creation, and he believes more of the incentive should be directed towards young companies, instead of imposing caps.

A focus on commercialisation preferred

Brad Parsons, founder and chief executive of Internet of Things device startup MOVUS, echoes McCauley’s sentiments, saying his recently-funded startup has been on the receiving end of the R&D refunds for the last few years and the incentive was “crucial” for his company in the early days.

However, he’s also calling for better focus and policing of the scheme.

“In the early years of a technology startup the R&D dollars are crucial, it is a major drawcard to keep MOVUS R&D within Australia,” he tells StartupSmart.

“I do understand the government’s perspective, however, the clear guidelines of the grant are that it is for the purposes of ‘generating new knowledge’. I suspect that the definition is perhaps too loose and open to interpretation.

“Our team are creating technologies that are globally unique, if this is to continue then we need the system to support us.”

Parsons also says the review of the R&D incentive should involve more focus on commercialisation. Australia’s capability in that space is “severely lacking” despite our leading stance on R&D capabilities, he says

“Any review of the R&D scheme should include the commercialisation phase also. It is our industry customers that benefit from the R&D dollars. Industry needs to be actively involved, R&D is not the whole agenda,” he says.

Caps “not the end of the world”

All things considered, McCauley says an annual cap of $4 or $5 million wouldn’t cut many startups out of the scheme, but some companies, such as scaling biotechs, would easily expend that cap annually. But any further restrictions would put the number of Australian startups staying on our shores in “serious jeopardy”.

“For a digital startup, a cap in the $4-5 million range wouldn’t be the end of the world if it meant the language in the scheme could be refocused,” he says.

“There’s this thing Australian startups are doing, which is building locally and selling globally, with Atlassian being an example of a NASDAQ-listed company still with headquarters and R&D happening here. That’s a model a lot of other companies are using too.

“That’s in serious jeopardy if the R&D incentive is restricted and Australian companies and jobs are in high danger of moving overseas.”

COMMENTS

SmartCompany is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while it is being reviewed, but we’re working as fast as we can to keep the conversation rolling.

The SmartCompany comment section is members-only content. Please subscribe to leave a comment.

The SmartCompany comment section is members-only content. Please login to leave a comment.